Company Name: | Maheshwari Associates |

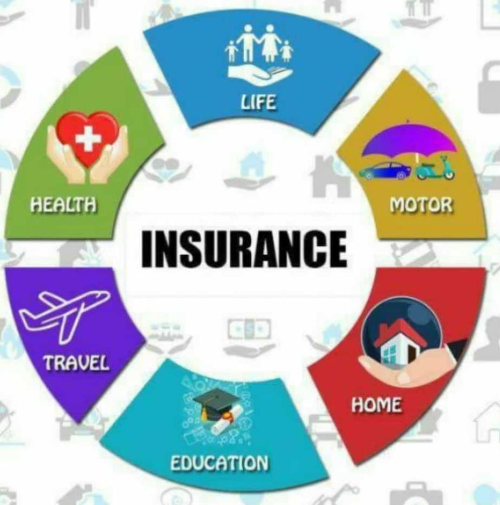

Category: | Insurance & Investment |

Year of Est.: | 2018 |

Nature of Business: | Service provider, Any type of insurance regarding services |

We are specialised in future financial planning. You can contact for any life insurance,Term insurance, wealth creation, Mediclaim, vehicle insurance, property insurance related works.

Employer employee policy, keymen insurance, W.C policy,

Like New policy, any type of claim, change in nominee, surrender, loan, transfer of branch, child marriage plan, child education plan, pension plan, Money back plan, whole life plan, many more

Contact now for best deal in any type of insurance

We are Tata AIA life believe in protecting your dreams at various.

stages of life without compromising on your basic needs

through Fnancial resources. You do not have to think twice to

live your dreams as they now come with guaranteed payouts.

We present to you, Tata AIA Life Insurance Smart Income Plus,

a limited pay income plan that meets tomorrow's requirements

along with protecting your loved ones and dreams as it ensures

you of guaranteed returns for the money invested.

Investment in this plan helps you fulfll your medium to long

term goals such as Child’s Education/ Marriage/ Business

start-up and Retirement planning.

Financial Security: Term insurance provides a lump-sum payout to your beneficiaries if you pass away during the policy term, ensuring financial security for your loved ones.

Affordable Premiums: Term plans typically offer high coverage at relatively low premiums, making it cost-effective compared to other life insurance options.

Flexibility: Many term plans allow you to choose the policy term and coverage amount that suits your needs, providing flexibility in tailoring the plan to your specific circumstances.

Tax Benefits: Premiums paid for term insurance plans are often eligible for tax deductions under Section 80C of the Income Tax Act, helping you save on taxes.

Peace of Mind: Knowing that your family will receive financial support in case of your untimely demise can provide peace of mind and reduce financial stress during difficult times.

Keep in mind that the exact benefits and terms may vary between insurance providers and specific term insurance policies, so it's essential to review and compare policies to find the one that best suits your requirements.